Supplier File

A supplier is a company you buy inventory from, which has a three-character, alphanumeric code. Generally, suppliers and manufacturers are the same, though some suppliers have no corresponding manufacturers. For example, you might need to buy material from a local competitor. You can buy the same items from multiple suppliers.

The Supplier File contains essential information about each supplier, including the address that appears on checks, summarized accounts payable (AP) statistics, and AP system parameters.

The Supplier File is shared by all companies using the AP and Purchasing Systems. More than one company can enter purchase orders, post bills, and write checks to the same supplier. All statistics are available for each company and for all companies. However, you should note that summarized statistics displayed on the Supplier File Entry screen are for all companies.

| Field Name | Description/Instructions |

| Supplier | Enter a three-character code for the supplier you want to inquire about, update, or add to the file. Try to use the first three characters of the supplier's name or another meaningful three-character code. |

| Comments | Comments or additional information. |

| Use as Remit to | If the supplier has a different address for purchase orders than for remittance, use this field to use the alternate address screen for the remittance address. |

| Default Expense Acct# |

The expense account number for this supplier. For suppliers, the account for Purchases or Trade Purchases is usually used. Each time an invoice for this supplier is entered in the Accounts Payable system, the default expense account number automatically appears. If this supplier requires split-expense invoices, press F10 to go to the Supplier Template, which provides a table for you to enter multiple expense accounts, cost centers, and so on, as needed. |

| Discontinue Date |

Enter date you wish to stop doing business with this supplier. Otherwise, leave this field blank. This field prevents the entering of a Purchase Order once that date has passed. This field also serves as information only for AP. |

| Tax ID# | This field lets you to enter the Tax ID for issuing 1099s to vendors, suppliers, and miscellaneous vendors. Tax ID numbers are created via menu option ACT 12 - Tax Identification Number File. |

| Supplier Template |

Assign the supplier to a template. Supplier templates allow you to enter more than one default expense account number, branch, cost center, and instructions as to whether to suppress discounts for each expense line when entering invoices for this supplier. If the invoices for this supplier are in a foreign currency, you can set up default exchange rate account numbers and cost centers for AP. Use of a supplier template is required for manifest reconciliation. |

| Default Cash Account | A cash account number entered as the default overrides the main system default, as entered in the Company File, when entering accounts payable invoices for this supplier. Leave this field blank, or enter all zeros, unless this supplier usually requires a cash account, other than the one set in the Company File, as the default. Use this field only under special circumstances, such as for a single company with multiple checking accounts. |

| Default Discount Account | A discount account number entered here as the default overrides the main system default, as entered in the Company File, when entering accounts payable invoices for this supplier. Leave this field blank, or enter all zeros, unless this supplier usually requires a discount account, other than the one set in the Company File as the default. This field should be used only under special circumstances, such as for a single company with multiple discount accounts because it has a foreign, as well as a domestic, payables account. |

| Default AP Account | An AP account number entered here as the default overrides the main system default, as entered in the Company File, when entering accounts payable invoices for this supplier. Leave this field blank, or enter all zeros, unless this supplier usually requires an A/P account other than the one set in the Company File as the default. Use this field only under special circumstances, such as for a single company with multiple A/P accounts. |

| AR Account | This setting allows you to link a supplier and an AR account, so that transactions relating to a supplier (which also affect AR) can be managed automatically. |

| Auto-PO Sort Code |

This field affects the automatic purchase orders generated as part of the Reorder Reports System. It has the following optional values:

If this setting is blank, the default setting automatically sorts purchase orders by item number. |

| Default FOB Code |

Unless overridden by a FOB code entered on the order header screen, the code entered here will be the FOB code used on purchase orders for the supplier. This field works in conjunction with the System Wide Setting - Options for Purchase Orders. If the setting Default File for FOB Code on PO in Order Entry is flagged to read the FOB code from the Supplier File, the FOB code is the default set in the Supplier File.

FOB codes are one-character codes that represent shipping freight terms. They are created via the Classification Codes File. If this FOB Code is left blank, the FOB code in the Purchasing Account (Account 00001 in the Billto File) is used. |

| Supplier Type Code |

This code works in conjunction with the Inventory Summary by G/L Account report (Menu GL Option 112) to categorize your receipts by supplier type. The following supplier type codes are available:

Codes are established via a system table, SUPPTYPECD. |

| Supplier Group Code |

This field allows you to assign a supplier/vendor to a group. The Supplier group provides another level of organization of payments. For example, you can group vendors by the type of product or service they provide, and generate checks by group. You can set up groups for installers, import suppliers, domestic suppliers, etc. Supplier/Vendor groups are established via the Supplier and Vendor Groups File (ACT 120). |

| Default BO | Enter 1 if you do not want to automatically issue a back order for unfilled quantities when receiving purchase orders. Enter 2 if you want to automatically issue a back order. |

| Lead Time | The average number of days between placing a purchase order with this supplier and receiving the merchandise. This field is for information or reference only. The Purchasing System only uses the lead time (delivery time) from the Product Line and Item Files. |

| Hold/Force # |

This field can provide a powerful tool for automatically paying vendor invoices. There you will see a payment option for automatically paying bills for all vendors through a given vendor invoice date or due date. Sometimes you want to pay certain vendors a little later or earlier than others, based on your knowledge of the vendor's expectations or systems. You can use this field to let the system know which vendors should be paid earlier or later. A positive number in this field tells the system to hold, or pay later, by the number of weeks you specify. A negative number tells the system to force, or pay early, by the number of weeks you specify. By assigning Hold/Force#s to all vendors you can create a flexible and automatic payment schedule for each supplier/vendor. For example, 03 in the Hold/Force# field of a certain vendor has the following effect: If you automatically pay all vendor bills through May 31, this vendor's bills will be paid only through May 10th. This vendor's bills are held three weeks longer. An entry of 03- (negative three weeks) causes this vendor's bills through June 21 to be paid. These bills are forced into being paid three weeks early. Furthermore, you can enter a 99 to hold all payments from the supplier or vendor until removed. This applies to check runs pulled by the company or vendor. Essentially this code stops any bills from being paid by the check writing programs. The only way to issue payment to a held supplier or vendor is manually. When the Cash Requirements report is generated all of this supplier's invoices will be placed on Hold. Furthermore the AP Inquiry Ledger will indicate that payments to this supplier are on Hold. You may also enter values from 1-98 and negative 1 to negative 99. This will hold (or force forward) payments by the number of weeks specified. For example, a value of 1 holds payments for one week more than the specified due date on the vouchers. By assigning Hold/Force numbers to all vendors this applies to, you can create a flexible and automatic payment schedule that incorporates separate payment schedules for each vendor or supplier. This field is used by the Accounts Payable system when using the Pull Vendor Invoices by Company Program. |

| Default Expense Cost Center | If you utilize the cost center for accounting purposes, and this supplier's invoices are always charged to the same cost center, enter that cost center code here. If a cost center is entered here, it automatically appears on the Accounts Payable input screen whenever invoices are entered for this supplier. If this supplier requires split-expense invoices, you may enter multiple default cost centers using the Supplier Template Screen. |

| Total POs this year | The number of purchase orders placed with this supplier during the current fiscal year. This is not an input field The information in this field is created and automatically updated by the system. |

| Total POs last year | This field reflects the total number of purchase orders placed with this supplier during the last fiscal year. This is not an input field. The information in this field is created and automatically updated by the system. |

| Open AP $ | The total AP amount open for this supplier for all companies. This is not an input field. The information in this field is automatically updated by the system. |

| Paid Last Year$ | The amount paid to this supplier in the last fiscal year for all companies. This is not an input field. The information in this field is automatically updated by the system. |

| Paid YTD$ | The amount paid to this supplier in the current fiscal year for all companies. This is not an input field. The information in this field is automatically updated by the system. |

| Payment Terms% |

This field gives you flexibility over two tier terms. Two tier terms have 2 due dates - one to get the discount, and a final net due date. For example, if a supplier's terms are 2% 15 Days, Net 30, then the AP system initially sets the due date at 15 days from the invoice date. With two tier terms activated, if the invoice is not paid by the due date, then the due date is changed to 30 days from the invoice date. Use this field to establish a discount, the days it is effective, and the net due date of the invoice. If you enter terms, then in Accounts Payable when you enter the invoice from this Supplier, the terms are pulled from the respective files. You can override the terms in Accounts Payable. The following are some examples of how these settings work:

Only enter the Net Days field if there is a discount, and the net days is greater than the discount days. |

| Payment Terms Days | The usual (default) terms offered by this supplier. Payment terms are calculated by two interrelated fields. The first field, followed by a percentage sign (%) allows you to enter the percentage of discount, if any, that this supplier gives upon payment received within a limited period. You can use the second field, followed by the word, Days, to define the maximum number of days within which any payment discount will be given. An entry in these two fields of 00200%, 30 days means that this supplier usually offers a 2% discount if bills are paid within 30 days of receipt. Terms can also be entered or overridden for each invoice. |

| Policy Codes |

Policy codes trigger special processing or identify certain suppliers or situations. These can be user-assigned or assigned by KerridgeNC. These policy codes created and maintained via the SUPPLIER/VENDOR POLICY CODES table (table ID SUPPPOLCY) accessed via menu option SET 29 - System Tables Maintenance.

If this policy code is used, when a PO or Faxable PO worksheet is generated, the UM and associated costing is in the Supplier specified UM. |

|

Installers Retainage Terms These settings define defaults used when systematic retainage is calculated. Retainage represents a percentage withheld from labor payable. The retained amount is documented and stored for individual vendor / supplier. Use of these settings are activated via the Options for Accounts Payable. |

|

| Retainage% | The percentage to withhold from the installer's payment. |

| Max Retainage$ | The cumulative amount that can be withheld from the installer's payments. |

| Accrued Retainage Amount | Cumulative retainage amount withheld to date. |

| Billto Offset Account# | AR account used during the calculation of credit payable when labor payable report is loaded into AP entry. Credit amounts are determined by open receivables within this account. |

| Default Liability Account# | Liability account used by retainage calculations. This account number overrides system default liability account. If no entry is made the default G/L accounts payable account number entered in the Company File is used. When you enter a vendor's invoice, you usually debit expense and credit Accounts Payable. When you issue checks, you debit Accounts Payable and credit Cash, and sometimes credit Purchase Discounts. |

| Default Liability Cost Center | You can allocate the expense to a specific three-character cost center number or code, or to no cost center by leaving the field blank. This cost center overrides system default cost center. |

|

Template Section The template settings allow you to enter more than one default expense account number, branch, cost center, and instructions as to whether to suppress discounts for each expense line when entering invoices for this supplier. When you create a Supplier File Template screen, it becomes the default AP Entry screen for all invoices entered for the supplier. |

|

| Invoice Amount in Foreign Currency |

Enter Y if the invoices processed in AP for this supplier are in foreign currency. Otherwise, enter N. If you enter Y, you must also enter into the next two fields. When you enter invoices for this supplier you enter the foreign currency invoice amount, and the conversions and exchange account number entries are created automatically by the AP program. To use this feature, you must first set up the Exchange Rate Table and the Supplier Currency Code Table in the System Settings Menu. |

| Default Exchange Payable Account and Cost Center | The default exchange payable account number and cost center code. |

| Default Exchange Clearing Account and Cost Center |

The default exchange clearing account number and cost center code. The default Exchange Payable account and default Exchange Clearing account are automatically inserted as FXP and FXC entries when invoices are entered for the supplier.

|

|

Template Settings: Account$ Discount$ Account Branch Cost Center Suppress |

Use the settings in the Supplier Template table to assign default values for this supplier. In most situations, you only need to enter an Account, Branch, and Cost Center. These defaults are automatically imported in the AP Entry screen when paying invoices for the supplier. For recurring invoices where the invoice amount is the same, such as for rent payments, you can enter an Amount$ and Discount$ (if applicable). |

The following options are available in the Supplier File.

Notepad

Store up to 99 pages of supplier notes.

Supplier Phone Numbers

This option allows you to store multiple phone numbers, extensions, fax numbers, and email addresses for each supplier.

| Field Name | Description/Instructions |

| Number Type |

|

| Area Code | Specify area codes except for Telephone and Fax numbers. |

| Phone#/Email | The phone number, fax number or email address. |

| Description | Description of what the number or email represents. |

| Extra Digit |

This setting is used for distinguishing local fax numbers (numbers that do not require an area code) and for distinguishing 10-digit fax numbers that require the 1 prefix. The following options are available:

|

|

PO (purchase order) AK (acknowledgments) SOPO (special order purchase order) |

Enter a Y to use the fax number or email address to send these documents. |

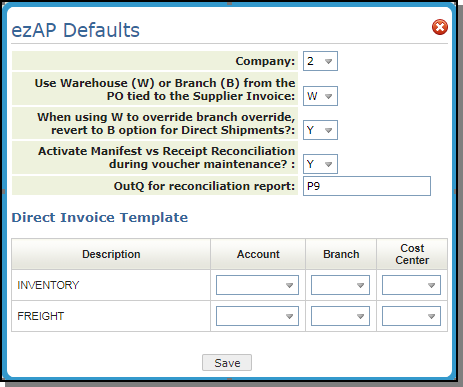

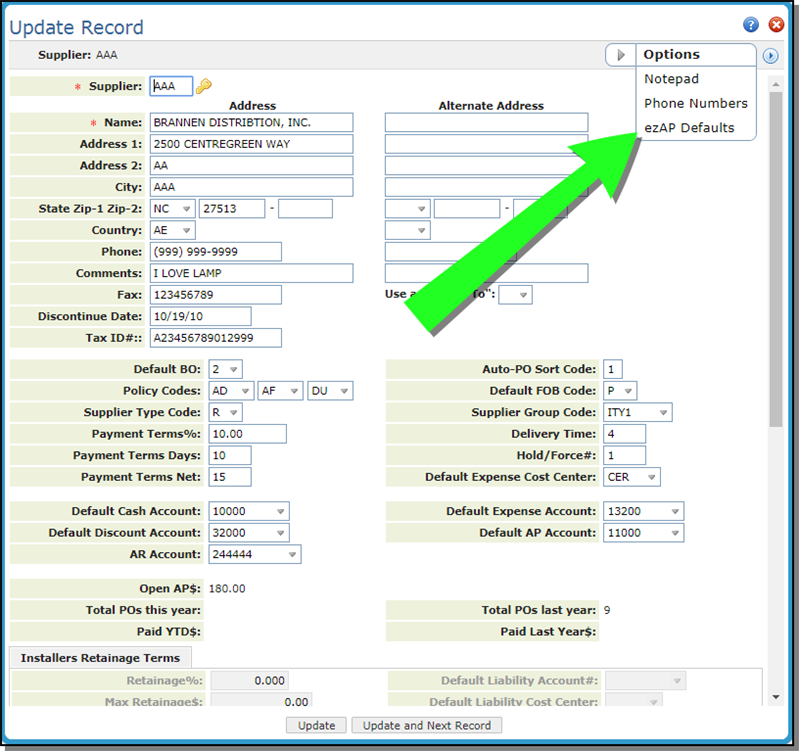

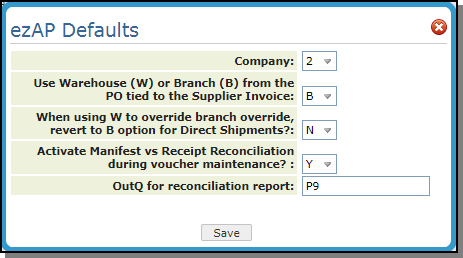

ezAP Defaults

ezAP is a third party application that provides the ability to scan AP invoices into Navigator so they don't have to be keyed in. The invoices are converted to XML and processed into the same screen that the EDI invoices land in. The invoices are in an unposted state.

When ezAP is installed and a token has been assigned, a ezAP Defaults option is displayed in the Supplier File drop down.

This option allows you to assign defaults that the system uses for reconciliation when the invoice is converted to XML to be archived and imported back into Navigator.

The Manifest vs Receipt Reconciliation Program displays and matches inventory receipts to voucher entries by manifest number. It further reconciles to cost center within each manifest. Therefore, you can view and automatically record multiple variances - one for each cost center within each manifest.

The OutQ for reconciliation report is required if the Manifest vs Receipt Reconciliation option is selected. The default is P9.

ezAP Defaults for Direct Ship Orders

Direct Invoice template uses INVENTORY and FREIGHT only.